All Categories

Featured

Table of Contents

[/image][=video]

[/video]

This implies the financial institution is making money in quite a couple of methods. 2) They take your money to pay their unlimited financial institution back when they take loans out of it.

If any of that went over your head, do not fret. And when you take out a car loan, every settlement you make back on the funding can go right back to the principal in your very own account.

Be Your Own Bank

No matter what occurs you constantly get ensured 4%. What this indicates is that your account always boosts and never ever goes down.

You can not take a loan out on yourself, if there's no money to take a financing from. Make good sense? Currently the interesting thing is that when you prepare to take a lending out on yourself, the firm you have the account with will offer you the quantity of money you're attempting to take out for a car loan.

But the cash will certainly never leave your account, and will proceed to generate and accumulate rate of interest also WHILE your funding is still superior. Example: So, state you have 500K in your account, and you take a funding from it of 500K. You will certainly have 500K in your hand to invest, spend, or do whatever with and at the very same time you will certainly still have 500K in your account growing typically between 57%, with no danger.

Certainly they can't offer you money for complimentary for no factor. The amazing component about this is that the money being held as security stays in your account.

Understanding The Basics Of Infinite Banking

You want to pay it back every month, since it assists with development. We do not suggest reducing it unless press comes to shove and you have to, due to the fact that it negatively influences the growth of the account.

People in fact attempt to enhance it since the manner in which substance rate of interest works: the longer you have the account open, and the even more you contribute, the much better the growthThe business that we make use of to open up these accounts are FOR revenue firms. So that being said, a few points to note: While you are not utilizing this money in this account, they are.

This suggests makes it a win win for both partiesAnytime you listen to words 'car loan' there is constantly a rate of interest associated with it. Usually speaking, on typical the lending prices are around 45% nonetheless, despite a loan impressive, your money is still expanding in between 57% to make sure that indicates that you're still netting favorable growth, despite a loan impressive.

And last however vital caution, one of the greatest barriers to getting started right away is that you need to have actually money conserved up initially prior to you can take a lending out by yourself money. There are many practical advantages and approaches for using unlimited financial. You can make use of a limitless financial finance to repay things such as an automobile, trainee lending, mortgage, and so on.

We are permanently in fact still growing money, as a result of interest that we are still able to collect on our account. Right here is an example of this listed below: Example: Let's consider a few various means someone can get an automobile for $50K. Alternative 1 You pay $50K cash and you receive the lorry yet your savings account has 50K much less.

Infinite Banking Real Estate

This alternative is worse than Choice 1, since also though you got the automobile, you shed 7,198.55 even more than if you had actually paid cash money. This option is NOT favored (however one that many people take since they do not recognize about various other options.) Choice 3 What happens if over those 5 years rather than paying off the financial institution vehicle loan, you were placing $833.33 right into our make up limitless financial monthly.

Now of course, the business when you took the financing out billed you a 4.5% passion (generally bc the business requires to earn money in some way)So you shed $5,929 to the rate of interest. However also after the financing rate of interest is taken, the total amount is $60,982 We still made a profit of $10,982, rather of losing $7198.55 to rate of interest.

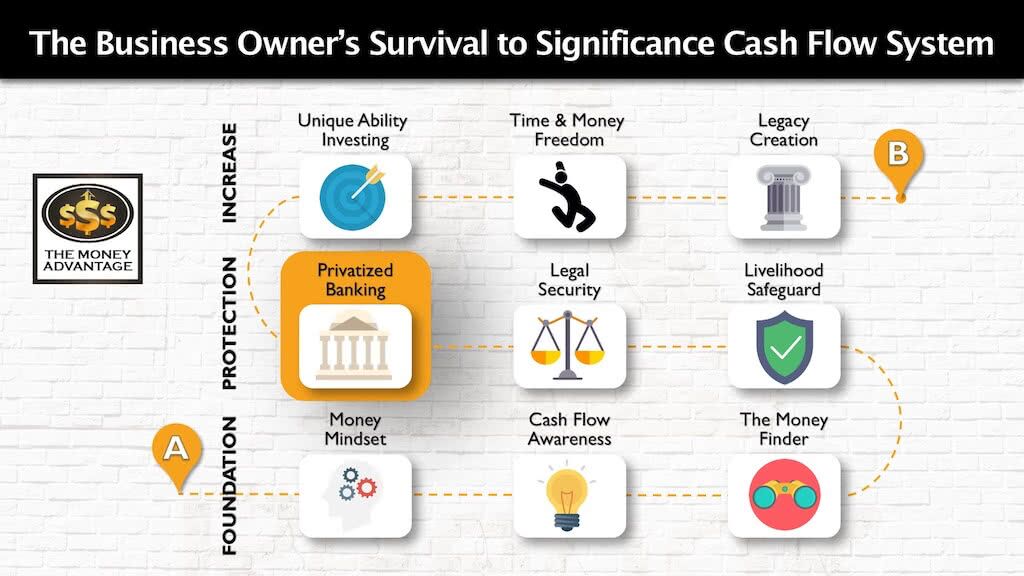

At our newest Sarasota Alternative Financial investment Club meeting Rebekah Samples spoke on the subject of "How to Become Your Own Bank and Utilize Your Money." She talked briefly about the 5Fs: Belief, Family, Physical Fitness, Financial Resource, and Freedom. She stated these are 5 things you need to do for yourself and you shouldn't outsource them.

Rebekah claimed we need to transform the means we consider our economic cost savings and future. We require to believe concerning our money similarly we think concerning what we utilize money for. If you wouldn't buy a car and not drive it, why would certainly you take your cost savings and not have it be beneficial to you now? Why allow banks profit of your cost savings? She spoke about just how financial institutions lend out the cash you deposit, they make a big earnings, which mosts likely to their investors, and you get a percentage of interest.

One method she chatted about was through dividend paying entire life insurance policy strategies, which allows you to utilize cash transferred right into them as your very own personal bank. Cash earned when the firm looking after the insurance provides this cash, returns to you as a returns, and not to the shareholders.

Can I Be My Own Bank? I Own A Small Business. ...

We have actually been shown to think that saving up for something is far better than obtaining money to acquire it. She revealed a chart that presented in both instances, we begin at zero and reach no, whether we obtained and gradually settled the financial obligation or we gradually saved up after that used the cash for the acquisition.

She claimed reward paying entire life insurance coverage intends enable you to act as your very own bank with tax-free development. This suggests that there's a significant gap in understanding the advantages these plans supply past simply fatality benefits. The reality is, when done appropriately, using life insurance as your individual bank can work.but it does not always work (more on that later).

Dive in to discover more Welcome to the globe of, an economic strategy that enables you to be your very own financial institution. You can establish up your own financial system by taking out a whole life insurance coverage policy and paying added costs over and above the fundamental insurance coverage amount.

Latest Posts

'Be Your Own Bank' Mantra More Relevant Than Ever

Infinite Banking Concept Wiki

Cash Flow Banking With Life Insurance